Dedicated Capitas Private Wealth Team

Capitas Financial provides life insurance sales support for UHNW clients of Bank of America Private Bank and Merrill Private Wealth Management. Click here for a Private Bank situational teaming overview.

Click on the state or region below to access your dedicated Capitas Private Wealth Team.

As a Firm, Capitas is positioned to support Bank of America and Merrill’s goal of incorporating protection strategies and wealth transfer solutions using life insurance into your client’s overall estate, business or financial plans. Through local and national Capitas resources, we can offer a highly customized approach required for your Ultra High Net-Worth Clients. Learn more.

Team Role Descriptions

The local Capitas Financial Private Wealth Support Team along with the national Private Wealth Centers can provide case consultation and planning options to enable financial advisors to enhance their practices by effectively integrating life insurance into the client’s overall estate, business or financial plans.

Building your practice with education and support for advanced insurance planning strategies

Please work with your local Capitas Team to view any of the below approved concepts and presentations.

Capitas Private Wealth Overview Presentation

Description: Local Capitas Point of Sale professionals are supported by one of the industry leading nationally recognized Private Wealth teams. The Capitas Private Wealth Team of “Special Ops” experts enable a wide range of insight and expertise related to Wealth Transfer & Estate Planning, Business Planning & Executive Benefits, Underwriting, and Premium Finance. Reach out to your local Capitas Financial Support Team to schedule a live consultation of this strategy.

Audience: Financial Professional Use Only

Private Financing Presentation

Description: Paul Stevenson, JD, LLM, and Damien Glennon, MSF, discuss Private Financing strategy in a 15 minute presentation. Reach out to your local Capitas Financial Support Team to schedule a live consultation of this concept.

Audience: Financial Professional Use Only

Estate Planning & Wealth Transfer Presentation

Description: Paul Stevenson, JD, LLM, and Damien Glennon, MSF, discuss Estate Planning for high net worth individuals and families in a 15 minute presentation. Reach out to your local Capitas Financial Support Team to schedule a live consultation of this strategy.

Audience: Financial Professional Use Only

Business Transition Planning Presentation

Description: Paul Stevenson, JD, LLM, and Damien Glennon, MSF, discuss business transition planning in a 15 minute presentation. Reach out to your local Capitas Financial Support Team to schedule a live consultation of this strategy.

Audience: Financial Professional Use Only

Approved Marketing Materials

Capitas Overview & Value Proposition for Bank of America Private Bank

Description: As a Firm, Capitas is positioned to support Bank of America’s goal of incorporating protection strategies and wealth transfer solutions into your client’s overall estate, business or financial plans.

Audience: Financial Professional Use Only

Expiration: 6/17/2026

Capitas Overview & Value Proposition for Merrill Private Wealth Management

Description: Capitas can develop strategies that address Merrill Private Wealth Management client’s unique planning objectives and needs for the Ultra High Net Worth marketplace.

Audience: Financial Professional Use Only

Expiration: 11/13/2026

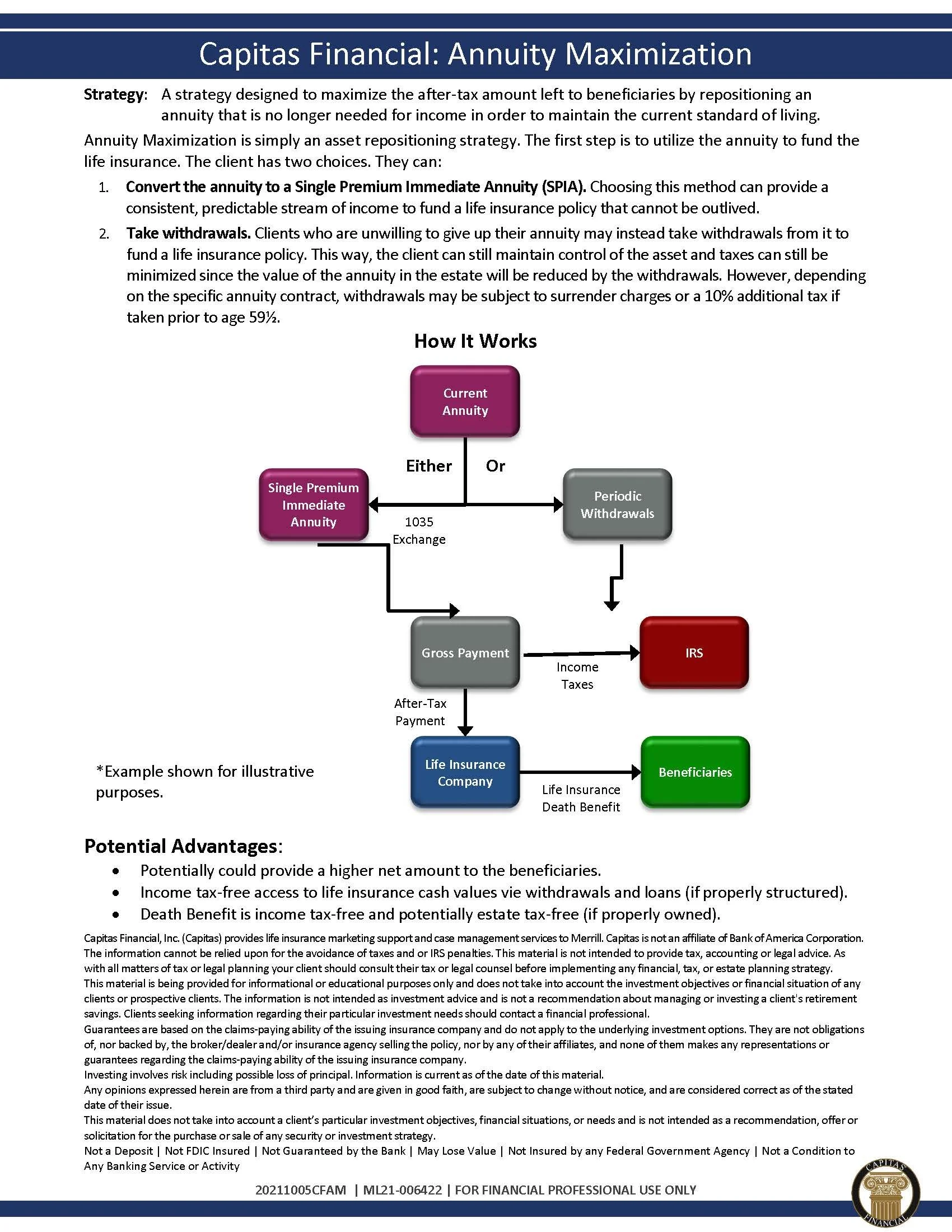

Capitas Concept: Annuity Maximization

Description: A strategy designed to maximize the after-tax amount left to beneficiaries by repositioning an annuity that is no longer needed for income in order to maintain the current standard of living.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

Capitas Concept: Buy-Sell Agreement

Description: A buy-sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity. It sets out rules and expectations about what will happen in the event of the death, disability, divorce, insolvency or retirement of any owner (a “triggering event”).

Audience: Financial Professional Use Only

Expiration: 5/21/2026

Capitas Concept: Buy-Sell Cross Purchase

Description: A buy sell agreement specifies what will happen to the interests of an owner, partner or shareholder who passes away or becomes disabled. If your company's buy sell agreement requires that the other owners or partners must purchase the deceased/disabled owner's interests, you can use life or disability insurance to fund the buy sell agreement rather than personal funds or business assets.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

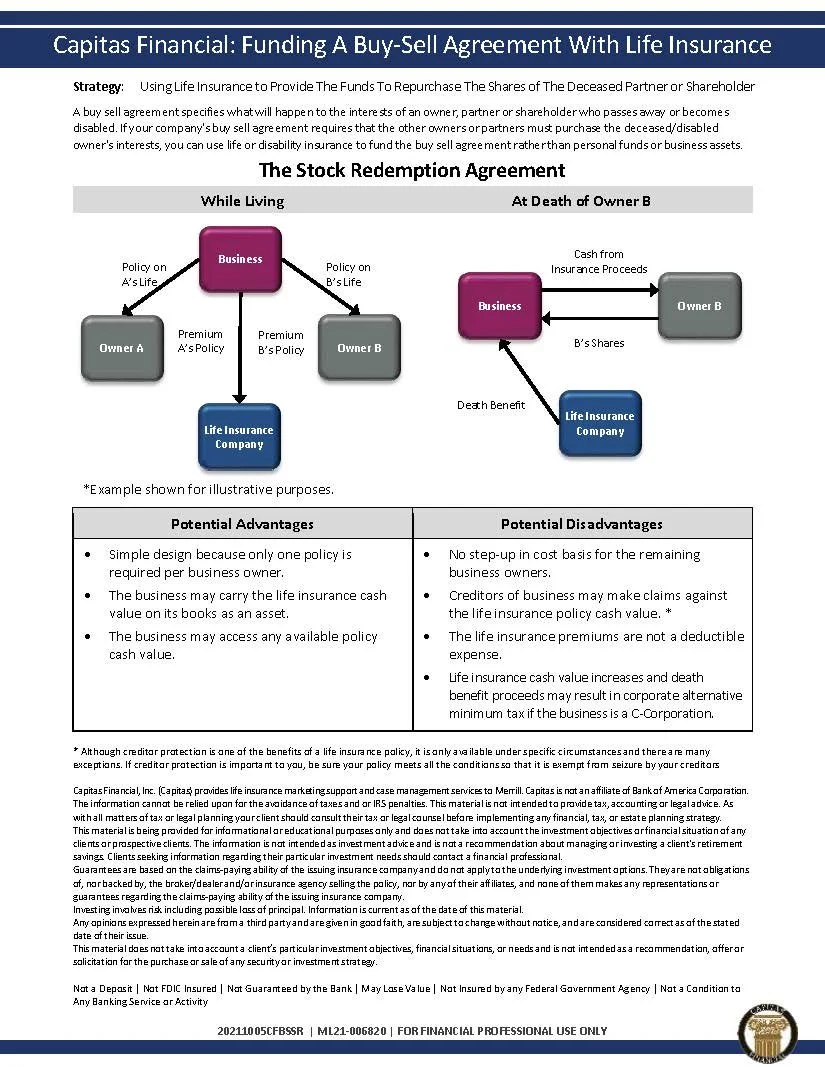

Capitas Concept: Buy-Sell Stock Redemption

Description: A buy sell agreement specifies what will happen to the interests of an owner, partner or shareholder who passes away or becomes disabled. If your company's buy sell agreement requires that the other owners or partners must purchase the deceased/disabled owner's interests, you can use life or disability insurance to fund the buy sell agreement rather than personal funds or business assets.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

Capitas Concept: Charitable Giving

Description: Charitable Giving may be top of mind for many clients. Financial Advisors should consider discussing with prospective clients the use of life insurance within an overall gifting strategy to enhance their charitable giving plans.

Audience: Financial Professional Use Only

Expiration: 2/24/2027

Capitas Concept: Charitable Remainder Trusts

Description: A charitable remainder trust (CRT) lets you make a substantial charitable gift now while retaining a defined income stream from the donated assets. The CRT is primarily a charitable-giving strategy with an added benefit — it lets you sell appreciated assets in the trust without incurring immediate capital gains taxes.

Audience: Financial Professional Use Only

Expiration: 4/28/2026

Capitas Concept: Executive Benefit Planning

Description: Non qualified plans are designed to retain, reward and recruit employees. These plans supplement qualified retirement plan benefits and can provide tax diversity.

Audience: Financial Professional Use Only

Expiration: 1/30/2027

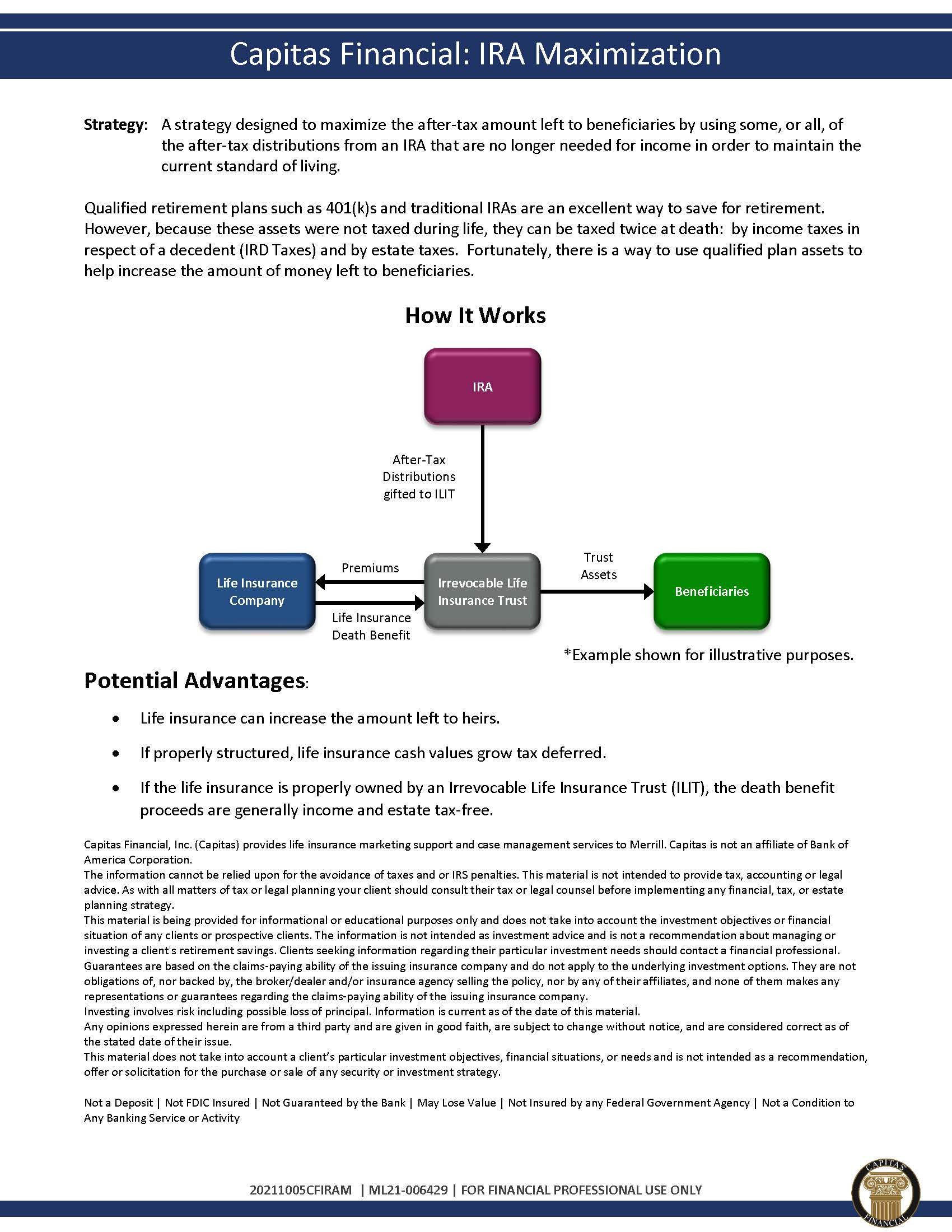

Capitas Concept: IRA Maximization

Description: A strategy designed to maximize the after-tax amount left to beneficiaries by using some, or all, of the after-tax distributions from an IRA that are no longer needed for income in order to maintain the current standard of living.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

Capitas Concept: Key Person Coverage

Description: Key person coverage commonly consists of life and/or disability insurance that the business owns on its key employees to protect the business. The benefit paid from a life insurance or disability insurance policy is generally tax-free and can help the business recruit and train a replacement, pay off debts, or transition the business in an orderly manner if desired. In a tragic situation, key person coverage can provide the company with financial options to make the appropriate adjustments.

Audience: Financial Professional Use Only

Expiration: 5/19/2026

Capitas Concept: Life Insurance as an Asset

Description: The concept of life insurance as an asset is an approach to help your clients in their long-term financial planning. Life insurance can help round out their overall portfolio by providing security and guarantees while not giving up growth potential, regardless of market performance. Life insurance is often thought of as a necessary expense to protect loved ones’ futures in the case of a premature death, but it has the potential to offer more when considering its advantages as an asset.

Audience: Financial Professional Use Only

Expiration: 2/24/2027

Capitas Concept: Life Insurance with an LTC Rider

Description: Nothing says financial security like a life insurance policy. It’s a great way to grow and preserve your client’s wealth, and in turn, leave a legacy for their loved ones. After determining the need for a death benefit, clients can get even more from their policy by combining it with an optional long-term care rider.

Audience: Financial Professional Use Only

Expiration: 4/22/2026

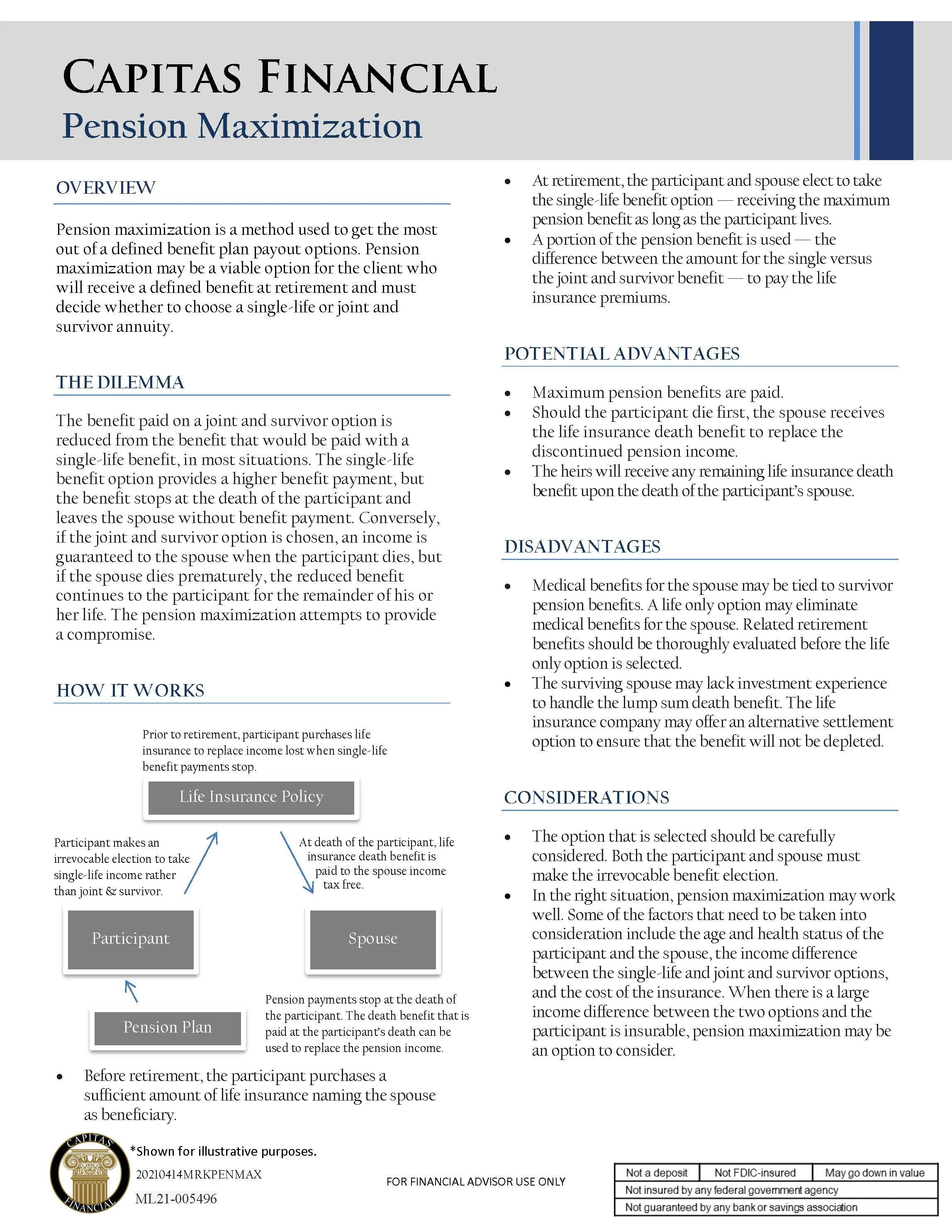

Capitas Concept: Pension Maximization

Description: Pension maximization is a method used to get the most out of a defined benefit plan payout options. Pension maximization may be a viable option for the client who will receive a defined benefit at retirement and must decide whether to choose a single-life or joint and survivor annuity.

Audience: Financial Professional Use Only

Expiration: 4/24/2026

Capitas Concept: Premium Financing

Description: A premium financing plan can be designed specifically to create the necessary estate liquidity while preserving estate assets for large estates of wealthy individuals.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

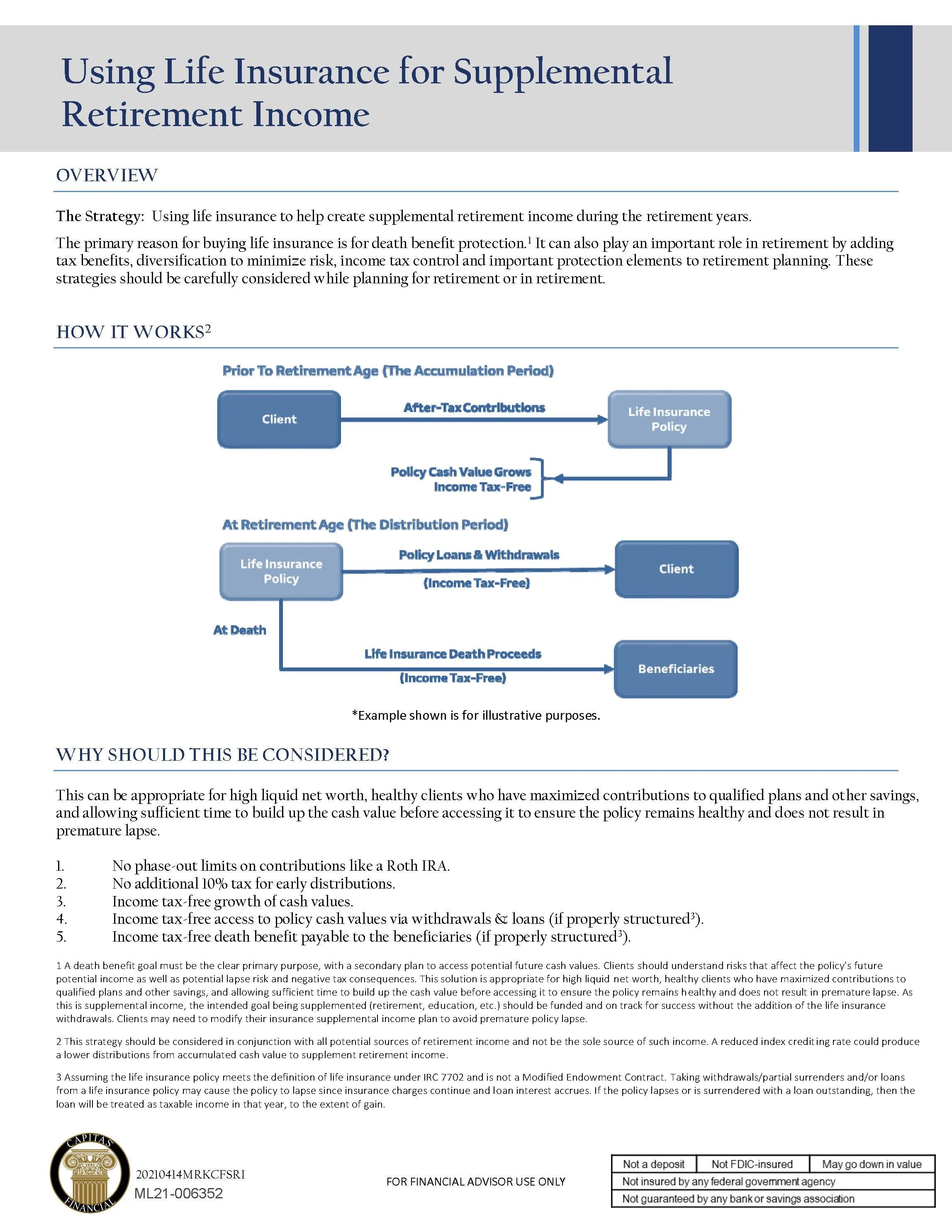

Capitas Concept: Supplemental Retirement Income

Description: This strategy involves using life insurance to help create supplemental retirement income during the retirement years. This can be appropriate for high liquid net worth, healthy clients who have maximized contributions to qualified plans and other savings, and allowing sufficient time to build up the cash value before accessing it to ensure the policy remains healthy and does not result in premature lapse.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

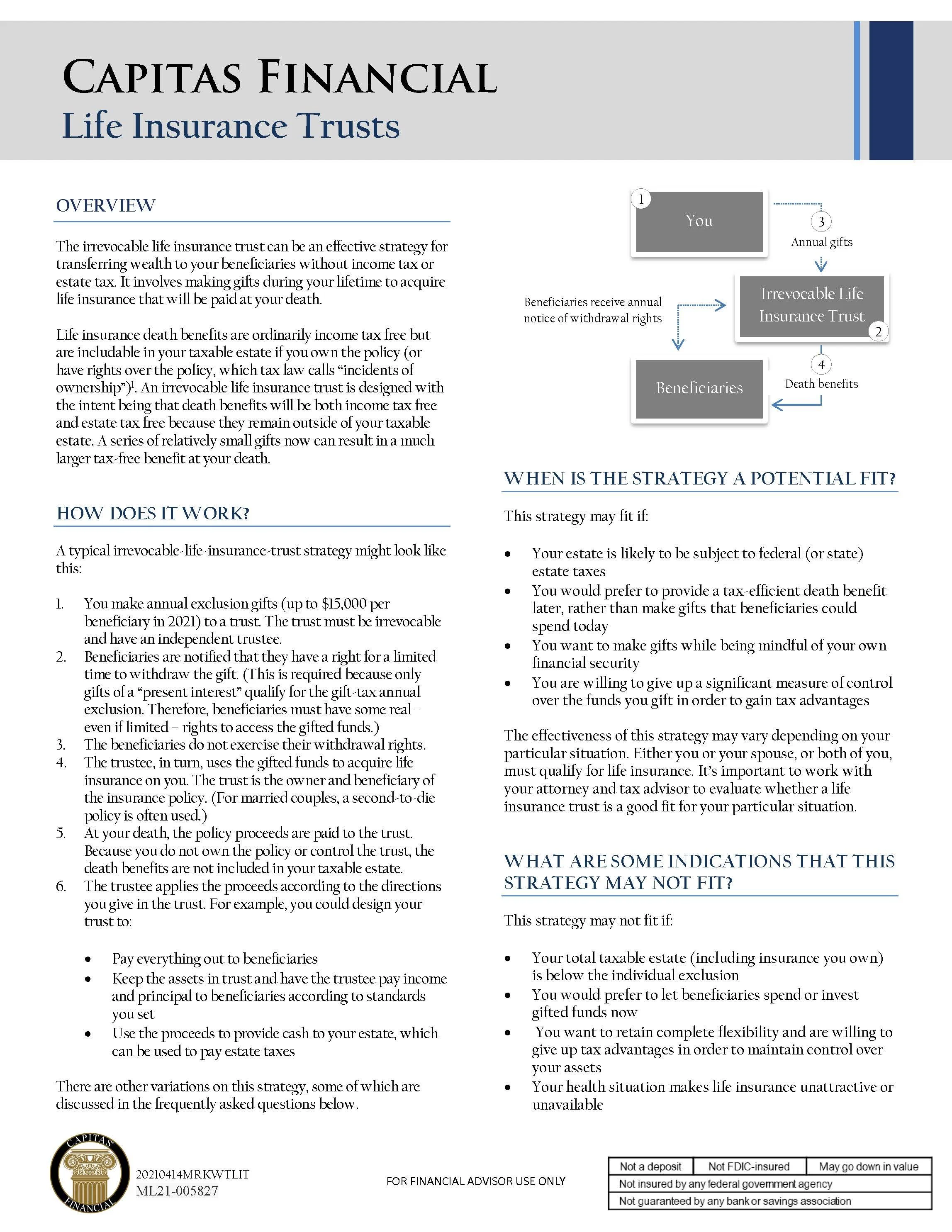

Capitas Concept: Using Life Insurance Trusts

Description: The irrevocable life insurance trust can be an effective strategy for transferring wealth to beneficiaries without income tax or estate tax. It involves making gifts during a lifetime to acquire life insurance that will be paid at death.

Audience: Financial Professional Use Only

Expiration: 6/9/2026

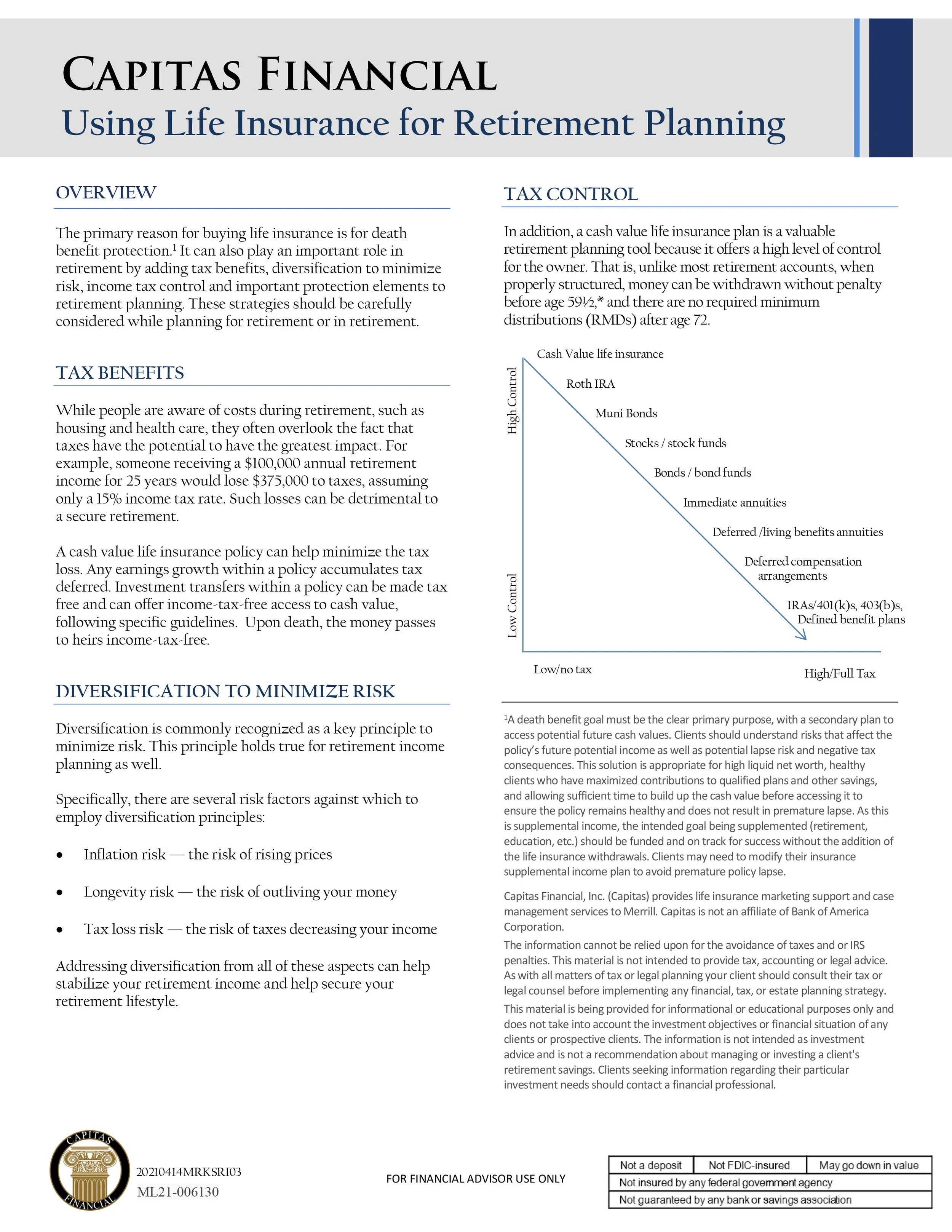

Capitas Concept: Using Life Insurance for Retirement Planning

Description: The primary reason for buying life insurance is for death benefit protection. It can also play an important role in retirement by adding tax benefits, diversification to minimize risk, income tax control and important protection elements to retirement planning.

Audience: Financial Professional Use Only

Expiration: 5/22/2026

3 Life Insurance Case Studies PDF

Description: This document outlines some reasons to consider Life Insurance Planning within your Private Wealth Business. Your clients look to you for advice and guidance with their financial lives, therefore a broader base of planning services allows you and your team the ability to offer additional, expanded services and products to help, protect and grow the financial lives of your key clients.

Audience: Financial Professional Use Only

Expiration: 10/28/2026

Capitas Private Wealth Centers

Capitas Financial Local Directors of Private Wealth and their team are supported by nationally recognized Private Wealth Centers.

Capitas Financial, Inc. (Capitas) provides life insurance marketing support and case management services to Merrill. Capitas is not an affiliate of Bank of America Corporation.

For Financial Professional Use Only. Not intended for use in solicitation of sales to the public.

ML25-001589